Where the techniques of Maths

are explained in simple terms.

Financial Maths - Series - Loans - number of periods, interest free & missing payments.

Test Yourself 1 - Solutions.

- Algebra & Number

- Calculus

- Financial Maths

- Functions & Quadratics

- Geometry

- Measurement

- Networks & Graphs

- Probability & Statistics

- Trigonometry

- Maths & beyond

- Index

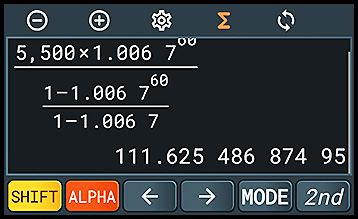

| Finding the number of periods for repayment. | 1. (i)

(ii) (iii) |

2.(i)

(ii) |

|

| 3. | |

| Repayment free period. | 4. (i)

(ii) (iii) The term 5000 × 1.00256 means the value of the loan would have risen by a factor of 1.00256 had there been no repayments. (iv) Milka paid 44 months @ $121.35 pm = $5,339.40. Hence total interest = $339.40. |

| Interest free period. | 5. (i)

(ii) (iii)

|

| 6. (i)

The monthly interest is 1% - so rate is 1.01. At the end of month 1, the balance is the $1,500 less the repayment. ∴ A1 = 1500 - R A2 = 1500 - 2R A3 = 1500 - 3R For the next payment, the interest starts to be charged and it is calculated on the balance of the loan - so here on $(1500-3R). A4 = (1500 - 3R) × 1.01 - R A5 = [(1500 - 3R) × 1.01 - R] × 1.01 - R

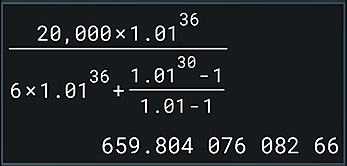

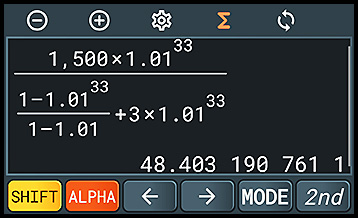

A6 = [(1500 - 3R) × 1.012 - R - 1.01R] × 1.01 - R = (1500 - 3R) × 1.013 - R(1 + 1.01 + 1.012) The month number is 6 and the index in the first term on the right is 3 and there are 3 terms in the series. So a three difference (only 33 terms in the series). The loan went for 36 months. ∴ A36 = (1500 - 3R) × 1.0133 + R × At the end of 36 months, there is a zero balance (A36 = 0). Rearranging we get

R = $48.40

(ii) $48.40 × 36 = $1,742.40 So $242.40 in interest. |

|

7. (i)

(ii) (iii) |

|

| 8. (i) $A6 = 80000 - 6R

(ii) (iii) |

|

| 9. (i) A10 = (150000 - 9R)1.0075 - R

(ii) (iii) |

|

| Missing payments. | 10.(i)

(ii) First calculate Ruby's balance at the end of Month 3 using the calculated value for R: Balance = $5,274.15. This makes the next calculations easier by not having to repeat the series from the beginning. Then calculate M4 and M5 by multiplying by the interest rate.

From M6 on, start a new series:

We can now form the usual series for the 55 months following the resumption of payments.

|

11. (i)

(ii) It is easier to do the next part if Matilda's amount owing at the end of her 3 months of non-payment is determined. Then a value can be used from which to build the next series. End of 2 months, Matilda owes $3,860.40 (from M2 above). After 3 more months with no payment, Matilda owes 3869.40 × 1.00753 = $3,947.91 Let P be the new repayment amount:

|

|

12. (i)

(ii) (iii) |

.

.

.

.